In a welcome bit of holiday cheer for hardworking Americans, Treasury Secretary Scott Bessent has predicted that 2026 will bring “gigantic” tax refunds, all courtesy of President Donald Trump’s sweeping tax reforms.

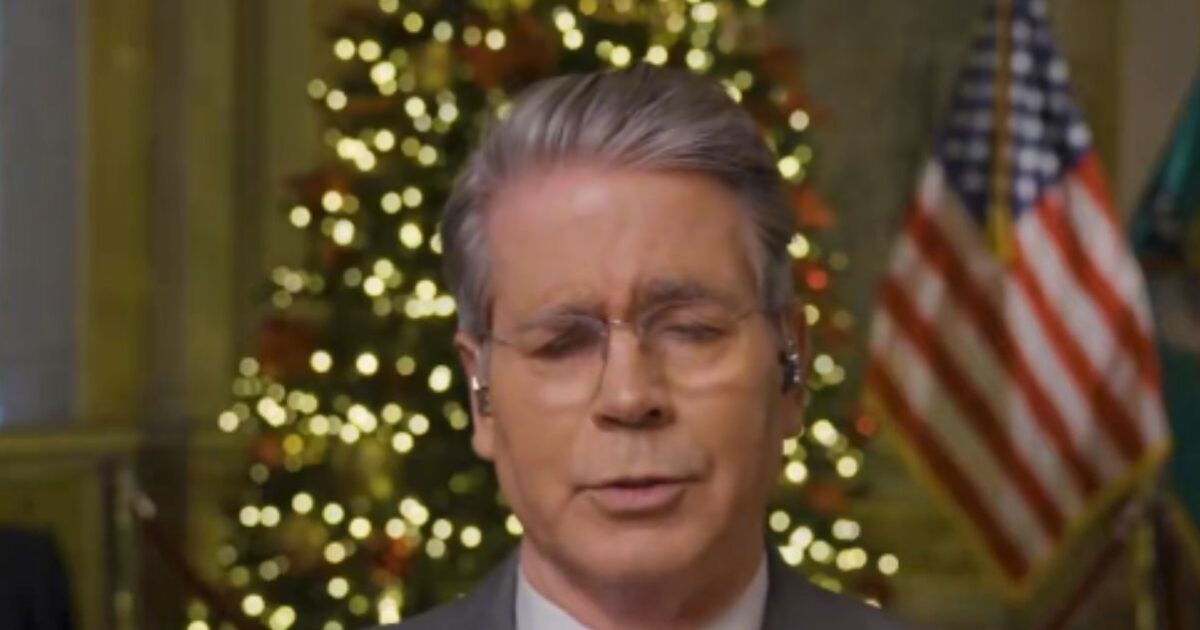

Bessent, who also serves as acting IRS commissioner, dropped this bombshell during a recent appearance on the “All-In Podcast,” highlighting how the One Big Beautiful Bill Act (OBBBA) is poised to put serious money back in the pockets of everyday families.

“I can see that we’re gonna have a gigantic refund year in the first quarter because working Americans did not change their withholdings,” Bessent stated plainly.

Bessent explained that since the OBBBA’s tax cuts were applied retroactively to the start of 2025, most workers continued having taxes withheld at the old, higher rates throughout the year. The result? Massive overpayments that will translate into hefty refunds when tax season rolls around in early 2026.

Bessent didn’t mince words on the potential windfall, estimating that households could see refunds ranging from $1,000 to $2,000, depending on the number of workers in the family.

“I think households could see, depending on the number of workers, $1,000-$2,000 refunds,” he added.

Bessent’s prediction is backed by hard numbers from the nonpartisan Tax Foundation, which released a report on December 17, confirming that the OBBBA’s $144 billion in individual tax reductions for 2025 could lead to up to $100 billion flowing back to taxpayers through refunds alone.

WATCH:

WOW! TREASURY SEC. SCOTT BESSENT: “I have the honor of being the IRS commissioner – and I can see that we’re going to have a GIGANTIC refund year in the first quarter 2026 because working Americans did not change their withholding.”

This is HUGE! pic.twitter.com/Q0rGUMHKnf

— Eric Daugherty (@EricLDaugh) December 23, 2025

The Tax Foundation’s analysis points out that average refunds could jump by as much as $1,000 per filer, though the exact amount will vary based on individual circumstances.

The IRS didn’t update its withholding tables after the bill passed, meaning Americans didn’t see immediate boosts in their take-home pay. Instead, the savings will hit all at once come refund time, a lump-sum bonus that could provide a much-needed economic jolt in the new year.

At the heart of these refunds are seven key tax cuts embedded in the OBBBA, designed to ease the burden on middle-class families and workers:

Increased Child Tax Credit: More support for parents raising the next generation.

Boosted Standard Deduction: Simplifying taxes and reducing what you owe.

Higher SALT Deduction Cap: Relief for those in high-tax states hit hard by previous limits.

New Deductions for Seniors: Helping retirees keep more of their hard-earned savings.

Auto Loan Interest Deduction: Making vehicle ownership more affordable.

Tip Income Deduction: A win for service workers who rely on gratuities.

Overtime Pay Deduction: Rewarding those who put in extra hours.

With refunds potentially totaling billions, it’s a clear sign that pro-growth policies are delivering for the American people.

The post WATCH: Treasury Secretary Bessent Says Americans Will See ‘Gigantic’ Tax Refunds in 2026 Thanks to Trump’s One Big Beautiful Bill Act appeared first on The Gateway Pundit.