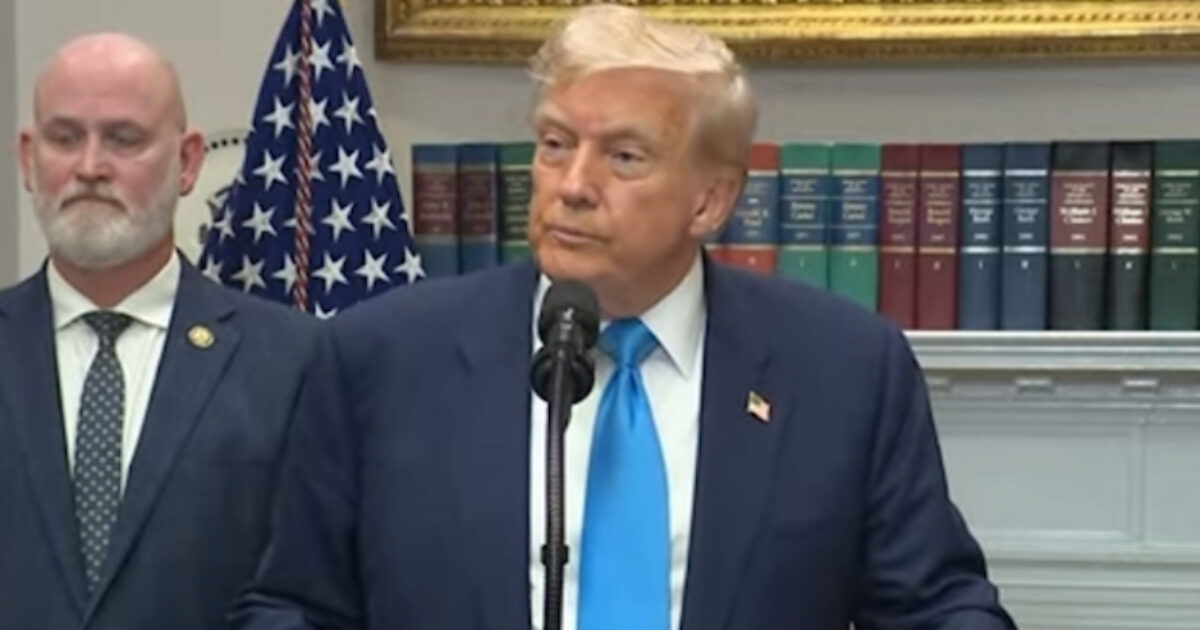

Americans who control the investments in their 401(k) retirement plans will be having a new world of choices under an executive order from President Donald Trump

Private equity investments and hedge funds, with both larger risks and potential rewards, will be fair game when the order takes effect, according to Fox Business.

“Expanding access to alternative investments in 401(k) retirement plans will provide more Americans with the diversification and investment options needed to build wealth and save for a successful retirement,” Corbett said, Bryan Corbett, president and CEO of MFA, a trade association

Trump’s Executive Order said that “more than 90 million Americans participate in employer-sponsored defined-contribution plans, the vast majority of these investors do not have the opportunity to participate, either directly or through their retirement plans, in the potential growth and diversification opportunities associated with alternative asset investments” such as real estate, commodities, and cryptocurrency.

The order changes nothing for the moment.

It gives the Department of Labor the task of examining the rules that govern 401(k)s under the Employee Retirement Income Security Act of 1974 and developing new rules that will open the gates to investments that are beyond publicly traded stocks and bonds.

The Treasury Department and Securities and Exchange Commission will also be involved to assess what rules they need to revise to bring Trump’s plan to life.

Trump’s order said 401(k) investors had been unable to pursue wealth at the same level as other investors.

“A combination of regulatory overreach and encouragement of lawsuits filed by opportunistic trial lawyers has stifled investment innovation and largely relegated 401(k) and other defined-contribution retirement plan participants to asset classes whose returns lack the very same long-term net benefits allowed for and achieved by public pension plans and other institutional investors,” the order said.

“My Administration will relieve the regulatory burdens and litigation risk that impede American workers’ retirement accounts from achieving the competitive returns and asset diversification necessary to secure a dignified, comfortable retirement,” Trump’s order said.

The SEC is ordered to “facilitate access to alternative assets for participant-directed defined-contribution retirement savings plans by revising applicable regulations and guidance strategies including longevity risk-sharing pools,” according to a White House fact sheet that said the goal of the order is “to attain stronger and more financially secure retirement outcomes.”

“President Trump is delivering on his promise to Make America Wealthy Again,” the fact sheet said, also saying, “President Trump wants to give American workers more investment options.”

The complexity of the task could work against immediate changes, according to CBS.

“While asset managers are salivating over the idea of tapping in to a portion of the $12.5 trillion in defined contribution assets, we believe adoption will be slow due to cost, transparency and complexity,” Pitchbook analysts wrote in a report.

Simon Tang, head of U.S. at Accelex, a private markets specialist, said the order is “good news for Americans,” but noted investors would see significant changes if they move out of publicly traded investments.

“When it comes to investing in stocks, retail investors are used to instant pricing, clean data and daily performance updates,” Tang said.

“Private markets are a different ballgame. There’s no real-time information, no ticker and no standardization, just fragmented documents and unstructured formats,” Tang said.

This article appeared originally on The Western Journal.

The post Trump Executive Order Opens Up a Whole New World of Possibilities for Your 401(k) appeared first on The Gateway Pundit.