Barclays has reported a 19 per cent rise in first-quarter profits, as market turmoil driven by Donald Trump’s return to the White House boosted trading revenues across its investment banking arm.

The FTSE 100 lender posted pre-tax profits of £2.7 billion for the three months to the end of March, beating City forecasts of £2.5 billion. The performance was powered by a surge in revenues from Barclays’ markets division, which capitalised on investor reaction to sweeping policy changes by the Trump administration.

Revenues in the markets business climbed 16 per cent year-on-year to nearly £2.7 billion, driven by a 21 per cent increase in fixed income, currencies and commodities trading, and a 9 per cent rise in equities. Activity soared as traders helped clients rapidly rebalance portfolios in response to new US trade and economic measures.

The gains offset a rise in loan loss provisions across the group, which increased to £643 million from £513 million a year earlier. Barclays said this included a £74 million charge for “elevated US macroeconomic uncertainty”, reflecting the potential impact of Trump’s newly imposed global tariffs.

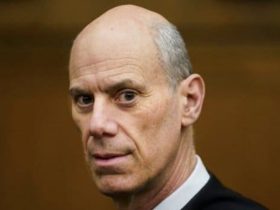

The results mark a win for chief executive CS Venkatakrishnan, known as Venkat, who unveiled a three-year transformation plan in early 2023 to revive shareholder confidence and reposition the bank. His strategy includes rebalancing Barclays away from its historically volatile investment banking arm and bolstering its UK consumer and corporate businesses, alongside a commitment to return £10 billion to shareholders by the end of 2026.

Investment banking fees also saw a strong uplift, rising 16 per cent to £1.2 billion from advising on takeovers, capital raises, and debt issuance.

Despite the market gains, challenges remain for Barclays as it navigates a shifting global landscape. Trump’s new trade tariffs, including heavy levies on Chinese goods, pose risks to the global economy and could threaten growth in the UK and US — key markets for the bank.

Venkat acknowledged the uncertain backdrop but struck an optimistic tone: “Our high quality, diversified businesses, together with proactive risk, capital and liquidity management and a robust balance sheet, position us well to support our customers and clients and deliver strong risk-adjusted returns in a wide range of macroeconomic scenarios.”

Barclays shares have performed strongly since Venkat’s turnaround plan was announced last year, but ongoing geopolitical and economic volatility may test the resilience of his strategy in the months ahead.

Read more:

Barclays profits jump 19% as Trump-fuelled market volatility boosts trading revenues